In a follow up post I’ll look at the 5-10-20 strategy applied to the Nasdaq 100 (which traders would be much more likely to trade than the full composite) as well as the S&P 500. To illustrate, the next graph shows historical drawdowns over the same period for the strategy (red) vs the index (blue).įinally, the last graph below shows that the 5-10-20 strategy (red) has been much more effective than the classic 50/200-day EMA crossover approach (blue) on this particular index. Damit warten jetzt bei rund 0,4962 USD und bei rund 0,53 USD die nächsten signifikanten Fib Widerstände. The average is also more reliable and accurate in forecasting future changes in the market price. It hasn’t been a magic bullet, underperforming the market in 16 of those years, but it has sidestepped every major bear turn, including our most recent. 1 day ago &0183 &32 Der XRP Kurs konnte am 200-Tage-EMA bei rund 0,433 USD bullisch abprallen und sich in Zuge dessen sogar wieder über den 50-Tage-EMA kämpfen. Over the last 37 years, this strategy significantly increased returns and reduced drawdowns and downside volatility with relatively low turnover (4.4 round-trips per year). SIMPLE MOVING AVERAGE Smooths out the price across each period to reveal short, medium and long term trends and potential areas of support or resistance.

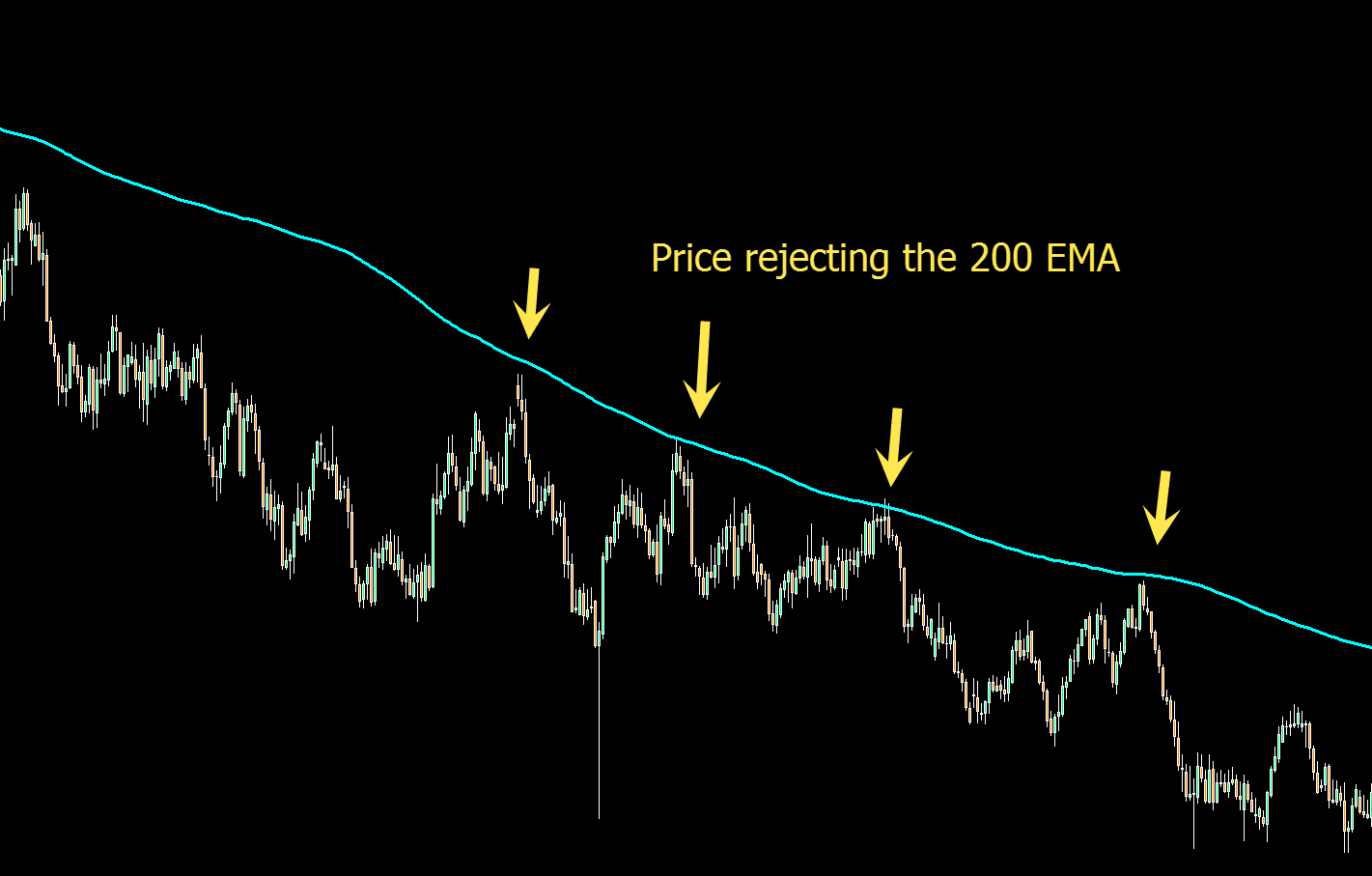

This test is frictionless and assumes a return on cash equal to half the nearest 3-month treasury yield. The exponential moving average, or EMA, gives more weight to recent price data than the simple moving average, or SMA, enabling it to react and move more quickly than the SMA. The graph above shows the Nasdaq (blue) versus the 5-10-20 strategy (red) from 1972. Close the position at today’s close when both the 5 and 10-day EMA cross below the 20-day EMA.Go long at today’s close if both the 5 and 10-day exponential moving average (EMA) cross above the 20-day EMA.I’ll put this granddaddy to the test against a classic trend-follower, 50/200-day moving average crossovers, here.ĭk applied the strategy to the Nasdaq Composite and I’ll do the same here: Timely display of Golden/Death Crosses on multiple. In this way, you do not miss out any trading opportunities even on the go. įor more information on ETFs, visit our ETF 101 category.This is a test of a trend-following system from the (now defunct?) blog Dk Report: the 5-10-20 strategy, hailed by Dk as “perhaps the granddaddy of all market timing systems.” That’s a tall order. Easy EMA Cross provides a comprehensive dashboard that allows you to view the formation of Golden/Death Crosses on multiple instruments across 6 timeframes (M5, M15, M30, H1, H4, D1) at one glance. It’s interesting to note that traders using this. The 200-day EMA helps us determine when we are in or out of an investment. The death cross and the golden cross are technical indicators that traders use in attempt to predict bearish and bullish market momentum, respectively. Buying the average 13/48.5-day golden cross produced an average 94-day 4.90 percent gain, better returns than any other combination. We like to use the 200-day EMA to identify strong long-term trends and momentum in an investment. Moving average preferences typically depends on an investors time horizons and objectives. Consequently, most technical analysts would monitor the SMA in identifying support or resistance levels. However, the SMA is a true indicator for the average prices over a specific time period.

The 200-day EMA is quicker to react to the most recent price changes in indexes such as the S&P 500, which is not surprising since the exponential moving average has a smaller lag time, or more responsive, compared to the the simple moving average. The difference between the two is noticeable when comparing long-term averages. Scan Description: near 200 sma Stock passes all of the below filters in cash segment: Latest Close Greater than Latest Ema ( close,200 ) Number 0.95 Latest Close Less than equal to Latest Ema ( close,200 ) Number 1.05 Market Cap Greater than equal to Number 5000 Running. The exponential moving average (EMA) provides more weight to the most recent prices in an attempt to better reflect new market data.

0 kommentar(er)

0 kommentar(er)